The Under The Radar Minute is an independent paid circulation newsletter and advertising report produced by NWBB Inc. . Under The Radar Minute nor any of its staff were compensated for the creation and/or publication of this article.

Under The Radar Minute makes no representations nor warrantees of any kind whatsoever regarding any of the information contained herin. This is not a solicitation nor recommendation to purchase any stock or other products from the

companies mentioned or any other companies. This article is solely for the purpose of informing our readers of information that was obtained through public sources. This paid advertising issue does not purport to provide an analysis of any

company’s financial position or prospects and this is not to be construed as a recommendation by The Under The Radar Minute and is not in any way to be construed as an offer or solicitation to buy or sell any security. Although the

information contained in this advertisement is believed to be reliable, The Under The Radar Minute and its editors make no warranties as to the accuracy of the description of any of the content herein and accept no liability for how readers or

listeners may choose to use it. The Under The Radar Minute, including any of our principals, officers, directors, partners, agents, or affiliates are not, nor do we represent ourselves to be, registered investment advisors, brokers, or dealers in

securities. Readers and listeners should independently verify all statements made in this advertisement. Product names, logos, brands, and other trademarks featured or referred to within this presentation and on line report are the property of

their respective trademark holders. These trademark holders are not affiliated with The Under The Radar Minute

The radio broadcast and on line report, and the opinions of those quoted within are for informational and advertising purposes only. Speculation in securities carries a high degree of risk, and investors purchasing speculative investments

should be capable of absorbing losses of all of their invested capital. There is no assurance that the featured company will receive additional funding or experience any future development necessary for corporate success. Information

contained in the broadcast and on line report contains forward-looking information within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, including statements regarding the

expected continual growth of the market for the company’s products, the company’s ability to fund its capital requirement in the near term and in the long term; pricing pressures; etc.

Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance may be forward-looking statements. Forward-looking

statements are based on expectations, estimates, and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently

anticipated. Forward-looking statements may be identified through the use of such words as expects, will, anticipates, estimates, believes, or by statements indicating certain actions may, could, should might occur.

Past investment performance is not in any way indicative of future investment performance. Readers must consult with registered professional investment, taxation, and portfolio advisors before making an investment decision. The

companies or “Company” or “Companies” or “Profiled Company” or “Profiled Companies”

Advertisement

The Under The Radar minute is a nationally aired radio segment providing information and awareness of

publicly traded companies currently “Under The Radar”

The Best 60 Seconds On Radio Devoted To Identifying Those Companies With Incredible Upside Potential

Copyright 2022 Under The Radar minute.

For question, comments or to suggest an article topic please contact :

Editor@UnderTheRadarMinute.com

Blue Biofuels may hold the key to a biofuels revolution making sustainable, cost effective and environmentally

friendly energy production a reality.

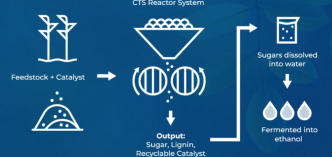

BIOF utilizes its proprietary and patented technology to make low-carbon renewable

biofuels from non-food plant materials, instead of corn. The patented process can convert

virtually any plant material such as grasses, yard waste, forestry waste and other plant

products into Ethanol, Sustainable Aviation Fuel, and other biofuels for use in the

transportation sector.

Blue Biofuels’ patented Cellulose-to-Sugar (CTS) technology does this in an environmentally friendly, renewable, and CO2 neutral

manner. There’s approximately 50 billion tons of plant biomass grown on the earth each

year. An estimated 8 billion tons of which could be sustainably harvested each year.

This is sufficient to fuel half the transportation needs of the world.

Blue Biofuels is able to convert all the cellulose from a plant into sugars and

consequently into biofuels, which is more than competing technologies. Blue Biofuels

has a higher yield of ethanol per acre than alternatives because its technology uses the whole plant, not just the fruit/corn of the

plant.

Blue Biofuels has a primary patent, and multiple additional patents pending for this

revolutionary new CTS technology process. The CTS process has a near-zero carbon

footprint. Blue Biofuels solved how to scale this technology for commercial use with its

patented reactor system. Blue Biofuels just announced that its newly built pilot plant

operates at 100 times the scale of a previous prototype.

Further the pilot plant has design features that are necessary to ensure scalability to

commercial size.

BIOF expects to be eligible for the large cellulosic D3 RIN

fuel credit from the US government that is currently worth

$1.94/gallon on top of the price of ethanol of $2.43/gallon.

Blue Biofuels has a game-changing technology and a management

team with a proven track record. BIOF’s technological

breakthrough may be the key to making green energy production a

reality, reducing greenhouse gas emissions and eliminating the

reliance on fossil fuels while propelling BIOF to the top of what is

estimated to be a $248 Billion biofuel market by 2027.

Do your research now on Blue Biofuels – Ticker BIOF

Visit The Blue Biofuels website HERE

This Week’s

Episode

This week on Under The Radar Minute where we report on fast-growing companies not covered by mainstream

Wall Street analysts —

We examine publicly-traded Blue Biofuels, trading under the symbol BIOF

This Week’s

Episode

Airing on the financial news networks of

SiriusXM

Latest Press Releases